Image source : Yahoo SG

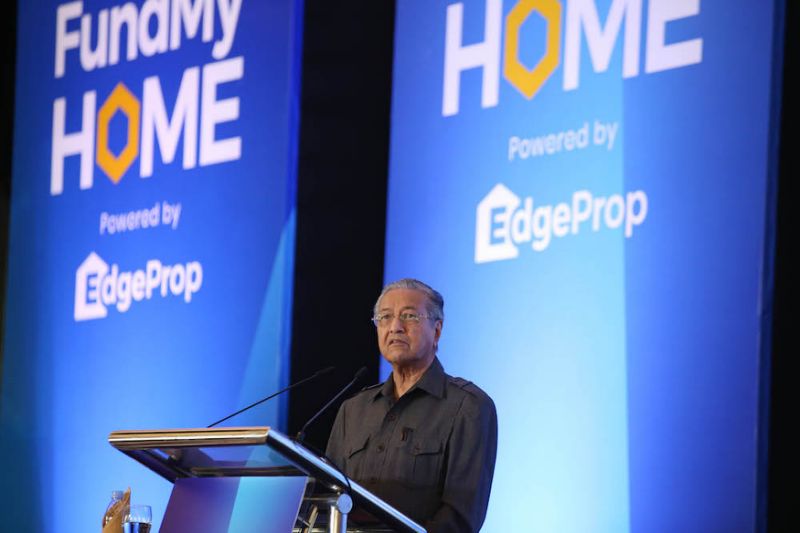

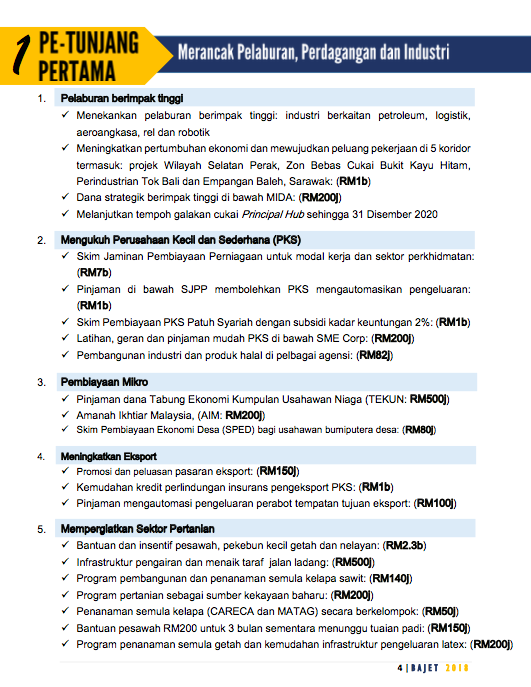

In the recent Budget 2019 speech presented by Finance Minister Lim Guan Eng, he mentioned on a scheme to help the Malaysian to own a house. It is called “FundMyHome”, the first peer-to-peer (P2P) financing scheme in Malaysia which initiated by EdgeProp Sdn. Bhd.

How the scheme works?

You can picture it as a crowdfunding to buy a property which involving 3 parties: Developer, Investor and of course you as the Buyer.

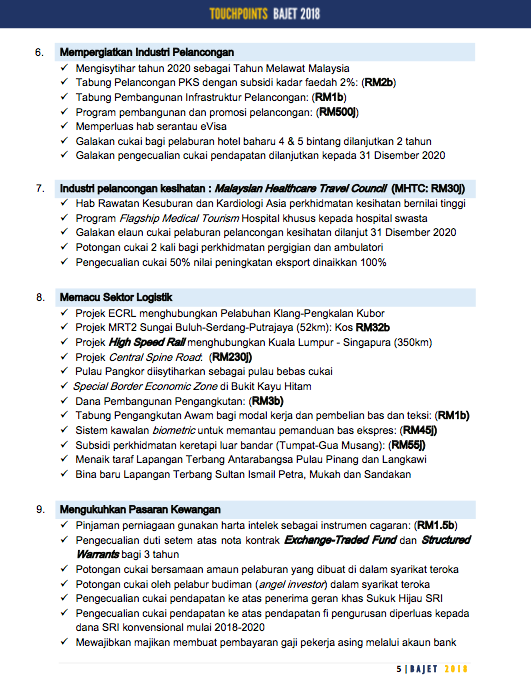

Buyer and investor will buy the property together from the developer based on the equity percentage 20% and 80%. The buyer will choose the completed property on their website and pay 20% from the property price. On the other hands, FundMyHome will find the investor to buy the remaining 80% shares.

The investor will get a steady 5% return per annum for 5 years while you as a buyer will have a 5-year staying period without having to pay a single cent. After 5 years, buyer can choose to sell or own the property by buying the remaining 80% equity based on the market price.

For example : Fathi is buying a Rm 200,000 property through this scheme. He needs to pay RM 40,000 (20%) while investor will pay the remaining RM 160,000 (80%). At the end of the 5th year, the property value assessed at RM 255,256 (Assuming the property price appreciate 5% per annum). If Fathi decide to buy the property, he needs to buy the remaining 80% equity from the investor based on the market price (80% x RM 255,256 = RM 204,204)

Different scenario if the property has 0% or negative appreciation in value which I think most likely will not be the case.

Is it good or bad?

Let’s see from the buyer’s perspective. From the way I see it, their main target clients would be the first-time home buyer and those that did not get any loan offer from the banks due to bad credit rating. It may sound pretty and hassle free but you need to know the consequences in a long run.

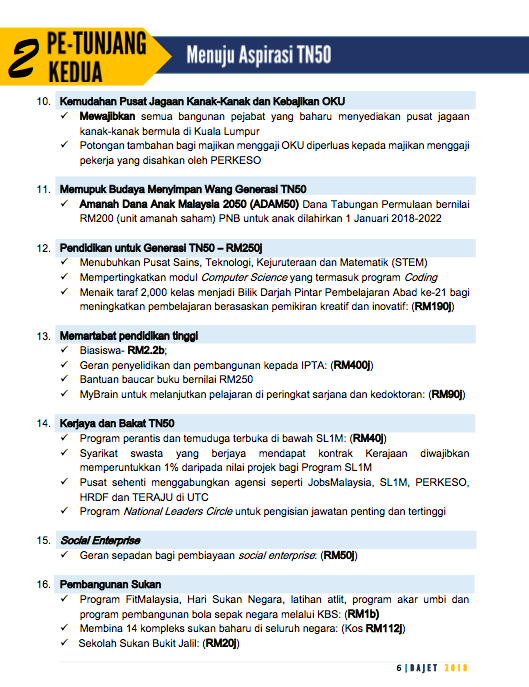

Most of the people I know are buying property either for own stay or investment.

If you are buying the house for own stay and you are eligible for bank loan, I would not recommend this scheme. You might end up paying more than the initial price. But if you are looking for investment, you can still consider this option as long as what you gain is more than what you pay. Bear in mind, the rental period is just limited to 5 years and the risk is high.

From the news and articles I found over the web, some says the scheme is the place where the developers dump their unsold property and selling them way above the market price. To be fair, I would not say that this scheme is totally bad. It might suit some people based on their financial situation and needs. Whatever it is, the choice is yours.

Part time independent writer and podcaster from Sarawak, Malaysia.

Image Credit : Frugal Entrepeneur

Image Credit : Frugal Entrepeneur Image Credit : The Balance

Image Credit : The Balance Image Credit : The Street

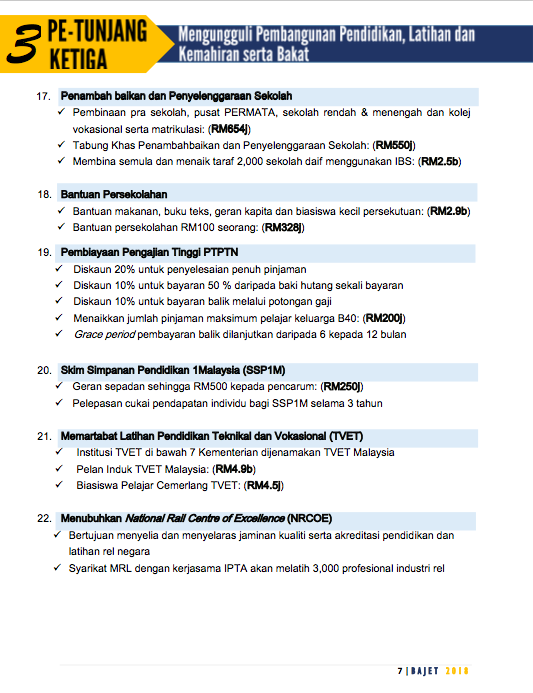

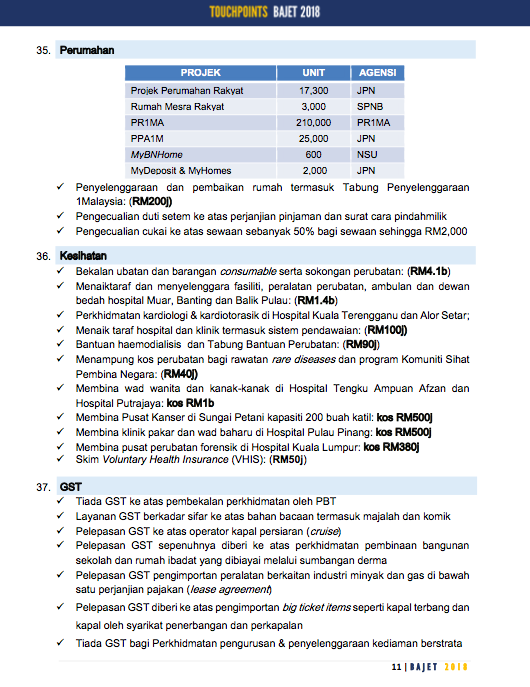

Image Credit : The Street